Due to longer life spans, higher medical costs and recession-impacted savings, the percentage of Americans staying in the workforce past age 65 is increasing. How does this affect your medical benefit plans?

Seniors will represent 21.0 percent of the total population by 2040.

Traditional Medicare has two main parts: Part A provides hospital coverage, and Part B provides medical services. Part D pays the cost of prescription drugs.

For most beneficiaries, Medicare Part A (hospital insurance) is free. Beneficiaries who enroll in Part B and/or D pay premiums. To avoid late enrollment penalties, individuals must enroll during their initial enrollment period, which lasts for the three months before their 65th birthday, their birthday month, and the three months after it.

Employees can enroll in Medicare Parts B and D even if they have employer coverage. To avoid paying premiums for coverage they might not need, some people with employer coverage do not enroll when first eligible. They can avoid late enrollment penalties for Part D if their employer’s plan qualifies as “creditable coverage.” This means the plan has an actuarial value that’s at least as good as Medicare Part D. In other words, the plan must provide benefits at least as good as Medicare’s.

Employers that provide prescription drug coverage must give Medicare-eligible employees a notice each year that tells them whether their drug coverage is creditable. Employees should keep these notices, as they might need them if deciding to join a Medicare drug plan later.

Coordination of Benefits

Generally, employers with 20 or more employees must offer current employees age 65 and older the same health benefits, under the same conditions, that they offer younger employees. If employers offer coverage to spouses, they must offer the same coverage to spouses 65 and older that they offer to spouses under 65. Failure to offer older employees the same benefits, or requiring them to enroll in Medicare, would violate ADEA, the Age Discrimination in Employment Act of 1967.

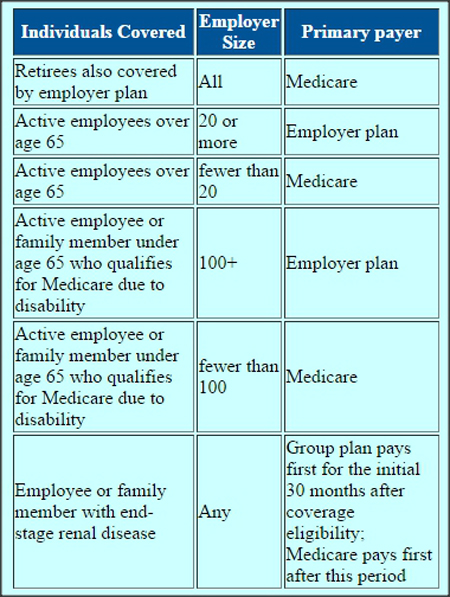

For employees who opt to have coverage under both the employer medical plan and Medicare, coordination of benefits rules apply. These determine which plan will pay first if the employee or a covered member has a health expense covered by both plans. An employer’s size determines which payer pays first.

Leave a Reply